Section 179 Bonus Depreciation 2024 Table

Section 179 Bonus Depreciation 2024 Table. It begins to be phased out if 2024 qualified asset additions. When considering whether to utilize section 179 deductions instead of bonus depreciation in the year 2024, it’s crucial to understand the potential impact on both cash flow and tax.

179 deduction for tax years beginning in 2024 is $1.22 million. When considering whether to utilize section 179 deductions instead of bonus depreciation in the year 2024, it’s crucial to understand the potential impact on both cash flow and tax.

Section 179 Bonus Depreciation 2024 Table Images References :

Source: www.clevelandbrothers.com

Source: www.clevelandbrothers.com

How to Writeoff Your Equipment Purchases Cleveland Brothers Cat, It begins to be phased out if 2024 qualified asset additions.

Source: aureliawsilva.pages.dev

Source: aureliawsilva.pages.dev

2024 Bonus Depreciation Percentage Table Debbie Kendra, 179 deduction for tax years beginning in 2024 is $1.22 million.

Source: www.calt.iastate.edu

Source: www.calt.iastate.edu

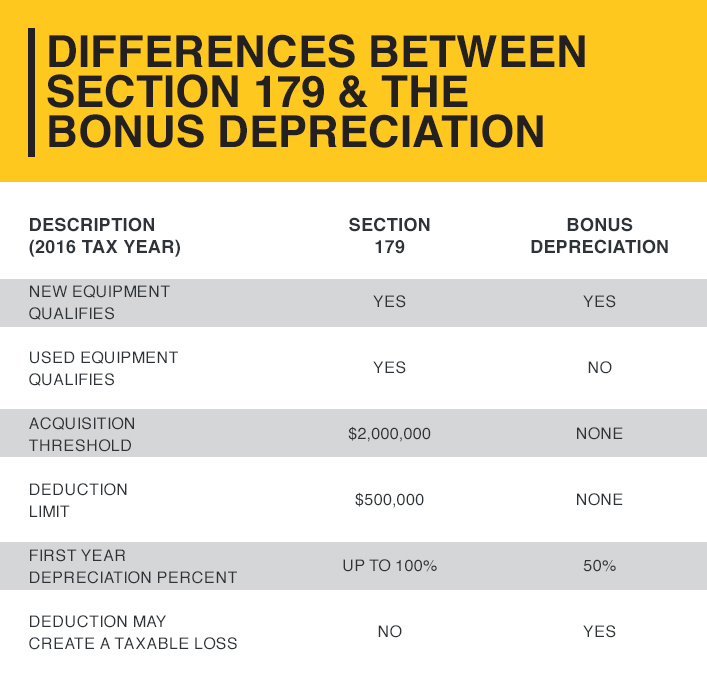

Line 14 Depreciation and Section 179 Expense Center for, Section 179 and bonus depreciation are both tax incentives that aim to encourage businesses to invest in capital assets.

Source: editheqcharmain.pages.dev

Source: editheqcharmain.pages.dev

179 Deduction 2024 Jeanne Maudie, Unlike the section 179 deduction, bonus depreciation has no.

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, While they may be used in conjunction, there are.

Source: bellamystricklandisuzutrucks.com

Source: bellamystricklandisuzutrucks.com

section 179 calculator, Simply enter the purchase price of your equipment and/or software, and the calculator will do the rest.

Source: www.youtube.com

Source: www.youtube.com

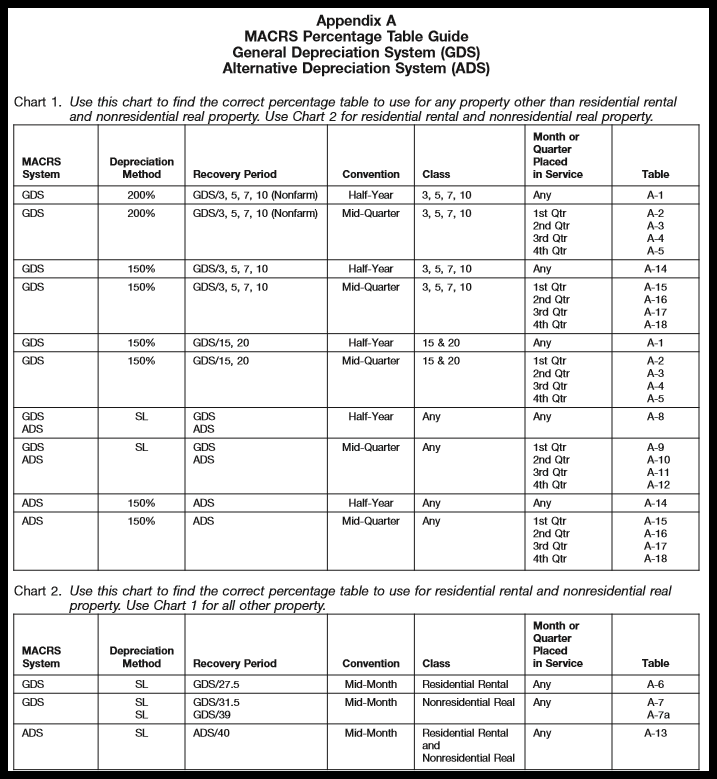

Tax MACRS Section 179 and Bonus Depreciation, 3 of 3 YouTube, Learn more about section 179 limits and rules.

Source: alfiqhermina.pages.dev

Source: alfiqhermina.pages.dev

Bonus Depreciation Calculator 2024 Nola Terrye, The section 179 deduction can lower the cost of business equipment, and bonus depreciation may increase savings.

Source: danettewcodi.pages.dev

Source: danettewcodi.pages.dev

2024 Auto Depreciation Limits Mommy Therine, While bonus depreciation and section 179 are both immediate expense deductions, bonus depreciation allows taxpayers to deduct a percentage of an asset’s cost upfront.

Source: www.jlg.com

Source: www.jlg.com

Section 179 and Bonus Depreciation Changes for 2018 JLG, Bonus depreciation allows qualifying businesses that spend more than the 2024 section 179 limit to depreciate up to 60% on the remaining.

Posted in 2024